Nathan Frei first seen the persistent ringing in his ears shortly after he returned from coaching with the US navy.

“I thought it was a noise from some electronic gadget and started looking around my apartment to find it. But then I realised the ringing was in my head,” says the 35-year-old former infantry officer from Langley, Washington.

Frei was identified with tinnitus and now, virtually a decade later, is one in every of 230,000 private harm claimants who’re suing the Minnesota-based conglomerate 3M, which they allege bought the military defective Combat Arms earplugs that prompted their listening to loss.

This is the biggest mass tort litigation in US historical past. Mass tort litigations are held in civil courts and contain quite a few claimants who allege to have been wrongfully harmed by a faulty product or drug. Unlike a category motion, through which a number of plaintiffs be a part of a single lawsuit, every plaintiff in a mass tort is handled as a person.

But the claims towards 3M could by no means be heard in court docket if the conglomerate succeeds in deploying a controversial chapter technique geared toward halting the litigation, which analysts estimate might value the corporate tens of billions of {dollars}.

The conglomerate, which denies its earplugs had been defective and prompted listening to loss, is following a latest pattern whereby US companies make use of the chapter court docket not as a result of they’re bancrupt however to handle tort claims.

3M is following within the footsteps of healthcare group Johnson & Johnson, which final yr utilised an identical however barely completely different chapter scheme, generally known as the “Texas two-step”, in a bid to protect itself from virtually 40,000 claims that its child talcum powder prompted cancers. J&J denies its merchandise harmed individuals, and didn’t reply to a request for remark.

The technique bought its catchy title from a Texas state statute that permits corporations to separate themselves into two separate entities and ringfence all authorized liabilities into one in every of them.

The corporations’ authorized groups declare the Texas two-step and different comparable loopholes will be optimistic for plaintiffs, as settlements will be reached extra equitably and extra rapidly. They argue the mass tort system is damaged, posing grave monetary dangers to corporations, and now not an environment friendly discussion board to ship justice to victims.

But tort legal professionals say chapter schemes deployed by solvent companies are an abuse of chapter courts, and deny wronged individuals their proper to trial by jury. Far from hastening a settlement, they argue, the chapter course of places the tort instances on maintain, thus eradicating a key incentive for corporations to come back to the desk to barter a settlement.

“These companies are weaponising the bankruptcy system against mass tort victims and the standard legal mechanisms used to compensate people who are injured by defective products,” says Adam Levitin, a professor of legislation at Georgetown University.

The authorized manoeuvre has attracted criticism from Congress. In February, Senate Democrats stated they had been drafting a invoice to outlaw the Texas two-step and comparable schemes. Senate judiciary committee chair Dick Durbin known as it a “get out of jail free card” for giant companies.

Now the courts are set to weigh in. The chapter schemes being utilized by a pair of defendants — J&J and 3M — are the topic of high-stakes litigation that consultants say might decide how mass torts are dealt with sooner or later. “If [the companies] succeed,” says Levitin, “it would open the flood gates for others to follow suit.”

What’s in it for corporations

Companies have used the chapter course of to handle giant tort liabilities within the US because the early Nineteen Eighties, when insulation producer Johns Manville Corporation filed for Chapter 11 — the part of US chapter legislation that allows restructuring of belongings, money owed and different affairs — to assist it reorganise within the face of $2bn of claims associated to asbestos.

The technique allows corporations to reorganise their enterprise, maintain their doorways open and estimate their complete tort liabilities with out the disruption brought on by defending a number of civil lawsuits. Litigation is often positioned on maintain throughout the course of and all instances are drawn right into a single discussion board that’s overseen by a chapter choose.

If claimants agree a settlement with the debtor over the tort claims, then the corporate, and in sure instances third events, can acquire safety from any future lawsuits associated to accidents allegedly suffered by individuals.

One of the most important proponents of utilizing chapter to deal with mass torts is Jones Day, a Cleveland-based legislation agency that devised the Texas two-step scheme deployed by J&J.

It lauded the scheme as “the greatest innovation in the history of bankruptcy” at a authorized convention in Washington in April, throughout which it defined how J&J was anticipated to face a torrent of talc litigation over the subsequent 50 years.

“What do you do about that as a company, no matter how big you are?” requested Greg Gordon, the Jones Day lawyer who has litigated all 4 Texas two-step Chapter 11 instances.

The first of those instances was filed in 2017 by Georgia Pacific, a subsidiary of privately held Koch Industries which nonetheless faces billions of {dollars} of asbestos claims. French cement group Saint-Gobain, Trane Technologies and J&J all adopted when hit with a swath of asbestos-related tort instances.

The scheme utilises a business-friendly divisional merger legislation launched in 1989 in Texas, which allows corporations to divide their belongings into belongings and liabilities. They then place the entity dealing with all of the tort claims into Chapter 11 and ask a choose to pause all instances towards each the subsidiary and the father or mother.

The Texas two-step and associated methods, such because the one utilized by 3M, allow the father or mother corporations to stay free from restrictions generally related to the chapter course of, resembling withholding dividend funds to shareholders.

In every case, the corporate established a belief designed to pay out settlements to victims which are agreed throughout mediation throughout the chapter course of.

What’s in it for claimants

The corporations who utilise chapter to settle mass tort instances body it as advantageous for claimants who in any other case must navigate advanced authorized mechanisms to hunt compensation.

Gordon advised the Washington convention the tort system was “literally a lottery for claimants” and the “large majority” misplaced.

Mass torts are sometimes dealt with in so-called multidistrict litigation (MDL), launched by Congress within the late Nineteen Sixties to streamline the method by consolidating particular person lawsuits filed in federal courts right into a single court docket.

In MDLs, a single choose oversees a course of that facilitates plenty of “bellwether” trials, which can be utilized as a information by defendants and claimants in the direction of how a lot the general potential legal responsibility and world settlement is likely to be.

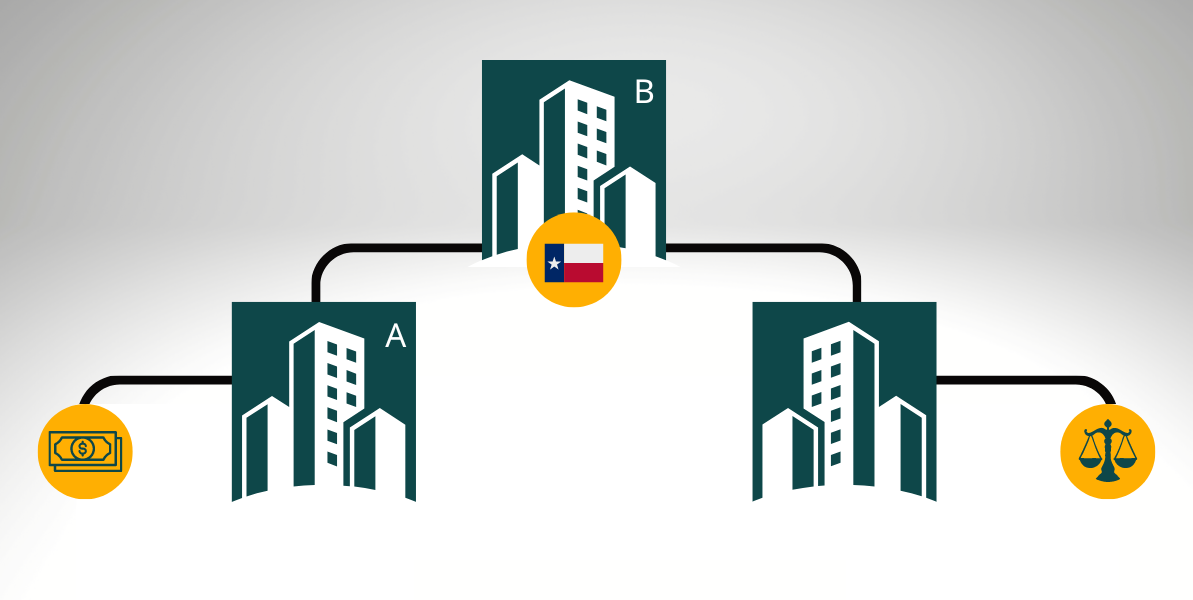

How the Texas two-step works

- Company A makes use of Texas’s divisive merger statute to separate itself and create a brand new subsidiary, Company B

- Company A transfers authorized liabilities to Company B

- Company B recordsdata for Chapter 11 chapter. It could transfer to a extra beneficial jurisdiction

- The mass tort litigation is placed on maintain by the chapter course of. Company A is free to proceed with its enterprise and pay dividends to shareholders

Prior to deploying chapter schemes, 3M and J&J had been each concerned in MDLs. The choose overseeing the 3M case had dismissed about 50,000 of the 280,000 claims and organised 16 bellwether trials to attempt to set the parameters for a world settlement. Plaintiffs had received 10 of those, and juries had awarded virtually $300mn to claimants.

In court docket paperwork justifying its chapter manoeuvre, 3M stated the litigation had change into a “lottery” whereby a number of the 230,000 claimants towards the corporate would obtain outsized awards from juries swayed by emotional testimony and “outright false” claims, whereas others bought nothing.

Bankruptcy, nonetheless, might present an “equitable, timely, and certain ending to this behemoth litigation”, it claimed.

“Most of those folks, if we stay in the MDL process, aren’t going to have their claims heard or addressed for a long time,” says Eric Rucker, 3M vice-president, affiliate normal counsel, litigation. “It would take many, many years or decades to do it.”

Claimants didn’t see it that means. After a 3M subsidiary chargeable for the litigation filed for Chapter 11 in July, halting all instances towards the corporate, a storm of controversy broke out.

Veterans’ teams slammed 3M, accusing the corporate of “betraying” navy personnel for a second time through the use of the chapter court docket to keep away from accountability to members.

Some claimants say the uncertainty over the way forward for the tort instances has elevated their stress and frustration as they search redress. “I think it’s a dirty move,” says Lakobi Hopson, a 39-year-old Iraq battle veteran who claims 3M’s distinctive yellow and black earplugs, nicknamed bumblebees by troops, prompted his tinnitus.

Hopson, who’s from Arkansas, desires his case heard earlier than a jury. “We decided to defend the country,” he says, “and the fact that [3M] would use us for profit and then throw us away, again, based on profit is disgusting.”

Claimants’ legal professionals accuse 3M of “forum shopping” — making an attempt to decide on a court docket that may handle their claims in a extra beneficial method — as a result of it’s dropping its arguments in court docket.

“3M is attempting to game the system,” says Bryan Aylstock, a court-appointed lead counsel representing earplugs litigants. “Asking the bankruptcy court to halt cases is a strategy to gain an unfair advantage.”

Judge Casey Rodgers of Florida, who spent three years sorting via virtually 280,000 earplugs claims as overseer of the MDL course of, was scathing in her personal evaluation of 3M’s chapter scheme.

“If successful, hundreds of thousands of individual plaintiffs will be deprived of their constitutional right to a jury trial while 3M — a fully solvent and highly profitable Fortune 500 company that will never actually file a bankruptcy petition itself — will reap all the benefits of the bankruptcy system without the attendant burdens,” she stated in an August ruling.

But 3M’s technique is at risk of unravelling following an August 26 ruling by Judge Jeffrey Graham, who’s overseeing its subsidiary’s chapter in Indiana.

Judge Graham refused a request to halt all earplugs litigation towards 3M, paving the way in which for the continuation of trials, which might undermine the rationale for its chapter manoeuvre.

The firm has since been granted go away to attraction, however Aylstock says Judge Graham’s ruling is “hugely significant” and would give solvent corporations pause for thought earlier than they try to “pervert the bankruptcy system” sooner or later.

An upcoming ruling in an attraction by talc claimants towards J&J’s use of chapter could be one other essential second, he provides.

The advantages of chapter

Legal consultants are divided on whether or not 3M’s preliminary authorized defeat will blunt corporations’ use of chapter schemes to deal with mass torts — and whether or not this might be a optimistic or retrograde step.

Supporters of the chapter choice level to the dismissal by a New Jersey choose of an preliminary attraction by talc claimants towards J&J’s use of the Texas two-step scheme.

Judge Michael Kaplan concluded the chapter court docket was the “optimal venue” for redressing the harms of current and future talc claimants and would guarantee a “meaningful, timely, and equitable recovery”.

“Maybe the gates indeed should be opened,” wrote Kaplan in his February judgment. “There is nothing to fear in the migration of tort litigation out of the tort system and into the bankruptcy system.”

An attraction towards Kaplan’s ruling concluded final month and a verdict is anticipated in coming months.

Bankruptcy can certainly profit claimants when in comparison with preventing instances in MDLs, say some authorized consultants. “There are a lot of great features of bankruptcy that don’t exist outside of the process. You can have this accelerated resolution and really a great outcome for victims,” says Samir Parikh, a professor at Lewis & Clark Law School.

MDLs are much less efficient in resolving mass torts, Parikh says, the place legal responsibility is disputed and there might be vital numbers of future victims. Because MDLs can solely resolve claims pending in federal court docket, it does nothing for individuals who undergo harms from faulty merchandise or medication a lot later. In most MDLs, solely a small fraction of instances are heard earlier than a jury — that means most claimants don’t get their day in court docket.

At the identical time, as a result of MDLs can not supply a complete settlement with the potential of finality, defendants are disinclined to place ahead their finest and highest settlement supply.

Chapter 11, nonetheless, gives the choice of securing a world settlement whereby all claims are channelled to a belief established for the only real goal of compensating victims, says Parikh.

The downside with the likes of 3M and J&J isn’t merely using Chapter 11, he says. “The problem is a number of these mass tort defendants have tried to have their cake and eat it too and have muddied the waters by trying to access the bankruptcy system on their own terms,” he says.

Delay, delay, delay

Although proponents of chapter methods say they will theoretically present a speedier decision for claimants, that isn’t at all times the case in apply.

So far, the legislation agency Jones Day has raked in additional than $70mn in court-appointed chapter charges associated to the 4 Texas two-step instances it has litigated, however as of but no cash has been paid out to claimants.

Clay Thompson, a lawyer who represents claimants who allege J&J’s child talc prompted their cancers, says the chapter scheme deployed by the corporate had delivered a “financial windfall” to shareholders, chapter consultants and professionals. But cash just isn’t going to victims, he provides.

The technique is finest understood as a delaying tactic, says Levitin of Georgetown University. “Without the pressure of trials to focus the minds of executives, companies using these bankruptcy schemes can delay and engage in a breath-holding contest over settlements with claimants, many of whom, particularly in asbestos cases, are very sick.”

Even distinguished critics of the MDL course of, together with Elizabeth Burch, a legislation professor at University of Georgia, have doubts about whether or not claims by defendants that their selections to deploy chapter schemes are motivated by a need to supply a fairer end result.

“Have defendants ever been concerned about speed or fairness for the plaintiffs? I think defendants are all about delay,” says Burch. “I think bankruptcy is qualitatively worse for the plaintiffs,” she provides, each when it comes to delays and compensation.

And for some claimants the prospect of not getting the possibility to have a trial earlier than a jury is upsetting.

“There are very few ways as a citizen in the US that you can hold a company to account and this is one of the ways,” says Frei, who nonetheless serves with the rank of captain within the reserve National Guard.

“If they can get away with it, then other companies are going to think well, you know, I can just hurt people and it doesn’t matter.”